maryland electric vehicle tax incentive

The Electric Vehicle Supply Equipment EVSE Rebate Program provides funding assistance for costs incurred acquiring andor installing qualified EV supply equipment also referred to as charging stations. Funding is currently depleted for this Fiscal Year.

Will Tesla Gm And Nissan Get A Second Shot At Ev Tax Credits Extremetech

The base amount of 4000 plus 3500 if the battery pack is at least 40 kilowatt-hours remains the same.

. The credit is for 10 of the cost of the qualified vehicle up to 2500. You can charge your EV at home if you have power where you park your car. Twice as much money was.

Maryland offers a rebate of 40 of the cost of Electric Vehicle Charging Equipment and Installation. The Maryland electric vehicle incentive EVsmart can help you to save 300 on your electric or plug-in hybrid electric vehicle expenses. EV and hybrid vehicle purchase incentives do benefit from some bipartisan support in Maryland and throughout the country.

Maryland Excise Tax Credit up to a maximum of 3000 for Electric Vehicle or Plug-in Hybrid. Federal Income Tax Credit up to 7500 for the purchase of a qualifying Electric Vehicle or Plug-in Hybrid. Maryland governor Larry Hogan plans to introduce the Clean Cars Act of 2017 to increase funds for the excise tax credit program and for the charging station rebate program4.

The rebate is up to 700 for. This charger plugs into a standard 120-volt outlets and it has the longest charging time. Department of EnergyThe total amount depends on the capacity of the battery used to power your car and state andor local incentives may also apply.

Most if not all of the utility companies in Maryland offer a 300 rebate towards the purchase of a qualifying Level 2 charger that allows for time of use data sharing with the utility. The 3 million allocated for Maryland electric vehicle tax credits in fiscal 2019 which ended in June was gone by November. Even local businesses get a break if they qualify.

Hybrid and Electric Vehicle Excise Tax Credit. For model year 2021 the credit for some vehicles are as follows. Battery capacity must be at least 50 kilowatt-hours.

Visit the Electric Vehicle Guide for help in choosing an EV model and finding rebates and tax incentives. Eligible purchase price on plug-in fuel cell. You may be eligible for a one-time excise tax credit up to 300000 when you purchase a qualifying plug-in electric or fuel cell electric vehicle.

The credit ranges from 2500 to 7500. Multifamily rebate awards may not exceed 25000 per site. STATE OF MARYLAND.

1500 tax credit for each plug-in hybrid electric vehicle purchased. Maryland PEV purchasers between July 2017 to July 2020 Type of Incentive. If you have any questions please email us at.

The program ends June 30 2017. Theres a standing 7500 federal tax credit on qualified new electric vehicles and a reduced credit for many new hybrids. PEVS are eligible for a one-time excise tax credit up to 3000.

Tax Credit Effective Dates. Maryland offers individuals who purchase or lease a qualifying plug-in electric vehicle a one-time excise PEV tax credit of up to 3000 while funds last. The money went to drivers of 1178 vehicles.

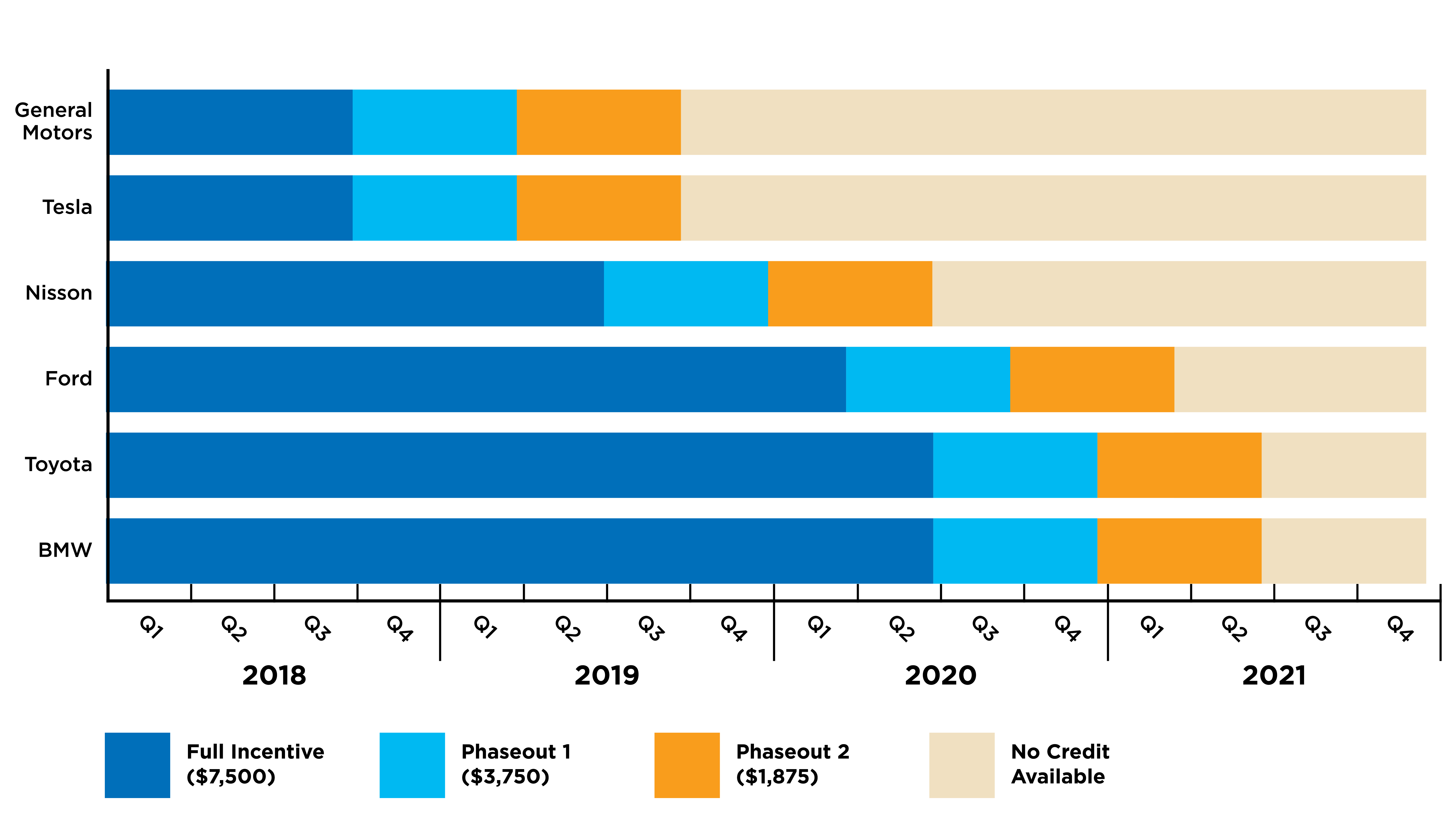

President Bidens EV tax credit builds on top of the existing federal EV incentive. Electric Vehicle Supply Equipment Rebate Program Through the program residents governments and businesses can acquire a state rebate for purchasing and installing an electric vehicle charging station known as Electric Vehicle Supply Equipment EVSE. Toyota is on the verge of running out of federal tax credits in the US as the Japanese company has sold more than 190000 plug-in electric cars.

How do I charge my vehicle. 750 rebate available for new or certain used Electric Vehicles with a final purchase price of 50000 or lower. Effective July 1 2017 through June 30 2020 an individual may be entitled to receive an excise tax credit.

If you purchased a new all-electric vehicle EV or plug-in hybrid electric vehicle PHEV during or after 2010 you may be eligible for a federal income tax credit of up to 7500 according to the US. Additional 1000 available for low income applicants. The tax break is also good for up to 10 company vehicles.

Utility companies Pepco Potomac Edison Baltimore Gas and Electric BGE and Delmarva Power have each partnered with the state government to offer a 300 rebate for purchasing and installing an approved level. Qualified PEV purchasers may apply for a tax credit against the imposed excise tax up to 3000. Maryland Freedom Fleet Voucher Program.

The Build Back Better bill will increase the current electric car tax credit from 7500 to 12500 for qualifying vehicles. The most current list of PEV policies in Maryland. A Level 1 charger comes with most electric vehicles.

Read below for incentives available to Maryland citizens and businesses that purchase or lease these vehicles. Federal Income Tax Credit A federal tax credit is available to buyers of new plug-in electric vehicles based on battery capacity and ranges. Maryland also has an incentive that allows electric vehicles to use high-occupancy vehicle HOV lanes no matter how many passengers are in the car.

Credit amounts for HEVs vary according to the portion of maximum power and energy supplied to the rechargeable energy storage system. The Maryland legislature also has a bill to revive funding for the states electric vehicle state excise tax incentive worth up to 3000 for electric vehicles or plug-in hybrids. BGE offers customers that own or operate multifamily properties a rebate of 50 of the purchase and installation cost of an eligible Level 2 EVSE up to 5000 per port and 50 of the purchase and installation cost of eligible DC fast EVSE up to 15000 per port.

3000 tax credit for each plug-in or fuel cell electric vehicle purchased. Plug-In Electric Vehicle PEV Tax Credit. Other Maryland Solar Incentives.

July 1 2017 - June 30 2020 Value of Benefit. The utilities will then credit your bill for. The incentive has a limit of 200000 units per.

For more information about claiming the credit see the Internal Revenue Service IRS Plug-In Electric Vehicle Credit website and IRS Form 8936 which is available on the IRS Forms and Publications website. The EVSE Rebate Program aims to reduce the financial burden of acquiring andor installing charging stations and to increase EV. The Maryland Clean Energy Incentive Act provides tax credits up to 2000 for electric vehicles EVs and up to 1000 for qualifying hybrid electric vehicles HEVs.

Outside of statewide incentives some Maryland municipalities have adopted their own local incentives such as solar financing solutions rebate programs for solar-powered electric vehicle chargers energy efficiency packages solar carport rebates and more. Marylands 3000 excise tax credit on EV vehicles and hybrids is still depleted for the fiscal year but it may be funded again in the future. Electric Vehicles Solar and Energy Storage.

Ev Tax Credit Calculator Forbes Wheels

Rebates And Tax Credits For Electric Vehicle Charging Stations

Going Green States With The Best Electric Vehicle Tax Incentives The Zebra

Ev Tax Credit Calculator Forbes Wheels

Maryland Ev Tax Credit Status As Of June 2020 Pluginsites

Which Incentives Are Driving Electric Vehicle Adoption

The Surge Of Electric Vehicles In United States Cities International Council On Clean Transportation

Electric Vehicles Charge Ahead In Statehouses Energy News Network

Incentives Maryland Electric Vehicle Tax Credits And Rebates